Sometimes I wonder where the point will be when I stop sharing my research. I find it easy to follow of course, because I made it all! However, the proper guidelines followed correctly can be true holy grails that should not be open to the public. I think…

That being said I will make the following note about the previous stat and my thoughts in general.

There’s a difference between “if x occurs, what’s the chance that y will follow?” vs “If y occurs, what is the chance that x came before it?”. Often times in fx we look for the first one. “If this candle pattern occurs, what’s the chance that price will reverse?” To me it’s the obvious question, and as such, the market hides it quite cleverly. Initially I wondered what was the use in doing the second type of research. However, doing it in a sort of backwards manners in some fashion forces the market to reveal it’s secrets if done correctly. It’s a bit like philosophy: you start with basic premises that MUST be true (or are taken to be true) and you build on those and go from there. It seems a little silly but if framed right and is further executed right, it works.

ex. I have always wondered “at what point can I know when the market is turning?”

the answer? It turns. Silly right?

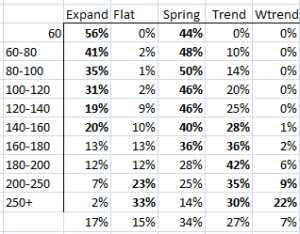

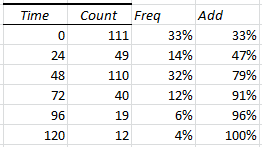

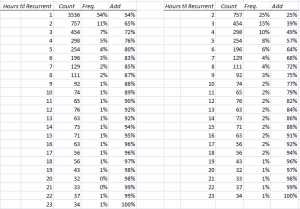

To further improve on this: at every swing top, a higher high MUST be made, and lower low MUST follow. A fractal pattern. for h=24 to be transient, h=1 through 23 must also be transient. There is a statistical bound where if h=x is transient, h=24 is now likely to be transient as well. Well above 50%, and saving much waiting time. This led to wondering if there was a pattern that occurred at tops and bottoms. Traditional candle stick patterns are bogus, or at least without proper context. What is proper context? When it’s contained within the proper wave framework or trend. (I’ve thought that when using too big of a frame, it requires a more significant pattern btw. This is something to look into..) So I ask the question: At the swing points, what kind of pattern occurs? This is type 2 question (If swing occurs, what’s the chance that x pattern came before it?) I get a distribution, which may or may not be helpful. However after this, I can still ask the type 1 question. Or, even better, I can now ask the type 1 question in an even better way (since often times, asking question 1 first will lead to 50-50 or 33-33-33 etc. distributions )! If the distribution from the type 2 question is favorable, I can now hunt specifically for those in question 1. It’s a filter on top of a filter.

Lets say I have 10 candidates for a pattern that is possible in the type 2 question. If I get a rough distribution of 10% on each of them, it’s useless. However, if I get that 4 of those patterns have a combined frequency of 70 or 80% of the possibilities, I’m in business. What I can do now is check the patterns against themselves. If a swing top occurred and Pattern A came before it 20% of the time, then what’s the probability that a swing top occurs after Pattern A? See the difference? Now I have found the exact pattern that still, may or may not prove to be useful, but it certainly will stand a better chance of turning something up compared to trying every pattern from the get-go.

I consider the “candle patterns before transient points” to be already filtered. They’re not true candles, but rather modded to be more accurate, and I think I could do some work to further improve it. What’s shown in the stat is the type 2 framed question, however I have gone on to flip it, and acquire the stats for that. (not shown because i’m still working on it). However, if filtered correctly, even if you can predict that a swing will occur after pattern A with 25% accuracy, that’s the chance of predicting a swing top/bottom. If the average wave length is 200 pips and the required stop is 20 pips, then well, 25% accuracy doesn’t look to shabby when the R:R is 9:1.

Also, thanks to NorthTrader for the vouch in the similarity thread to get me unbanned, although it was kind of nice not responding to anything because I couldn’t :p